“The single most realistic and effective way to move forward is to change the investment strategies and approaches of the players who form the cornerstone of our capitalist system: the big asset owners . . . If they adopt investment strategies aimed at maximizing long-term results, then other key players—asset managers, corporate boards and company executives—will likely follow suit.”

This quote by McKinsey Co. global managing partner Dominic Barton and Canada Pension Plan Investment Board CEO Mark Wiseman encapsulates what this book seeks to achieve. We focus our attention on the building blocks of the capitalist system, the large-asset owner-investors, and examine how they can more positively impact their own fiduciaries as well as the wider economy and society.

With the global population expected to increase to ten billion by 2050 and the proportion of people living in cities expected to double, the strain that this will place on existing infrastructure, housing requirements, farmland, and other natural resources will be profound. In order to avoid the effects of irreversible climate change, deepening inequality, and even military conflicts over resources, we will need to unlock large pools of long-term capital to fund resource and infrastructure innovation. We classify long-term investments1 as investments in illiquid, private-market asset classes such as infrastructure, clean energy, real estate, venture capital, agriculture, timber, and private equity that can produce attractive financial returns and, by their nature, can have significant impacts in the economy and wider society.

It is critically important for the health of our capitalist system and indeed the world that the global community of long-term investors begin investing in long-term projects that will help address our global challenges and prepare us for this future state. According to the Organisation for Economic Co-operation and Development (OECD), the community of long-term investors has more than $100 trillion in assets under management,2 which means there should be plenty of capital available for the costly economic transitions ahead.

The significance of long-term investing for large institutions has risen to prominence after the drawbacks of short-termism and myopic behavior were exposed in the financial crisis of 2008–2009. The crisis highlighted badly misaligned economic incentives; the poor performance of highly leveraged, complex financial institutions; and a lack of value-add from the short-term-oriented financial services sector. Financial regulation since has attempted to provide reform for long-term stability and restore discipline in the market place. Such changes in behavior are crucial for megabanks but also for the largest holders of capital, typically asset owner institutional investors located around the world.

So who are these long-term investors and what are their characteristics? Institutional investors or asset owners3 such as sovereign wealth funds, endowments, foundations, family offices, pension funds, and life insurance companies have long-term profiles and can be separated from mutual funds, private-equity firms, and other asset management firms that invest on behalf of the institutional investors, sometimes criticized for their more short-term-oriented behavior. Sovereign wealth funds (SWFs) are institutional investors set up by governments and are usually funded by budget surpluses to provide long-term benefits to a nation.4 Pension funds provide retirement payments for pension scheme members and consist of either defined-benefit or defined-contribution systems. Defined-benefit plans are required to pay a certain amount to their beneficiaries at a certain time in the future. Defined-contribution plans, instead, are based on contributions and the performance of investments to generate a retirement annuity for plan beneficiaries. Life insurance companies are considered long-term investors because of their requirements to pay beneficiaries or policyholders in the future. Endowments/foundations are used to fund the expenses of nonprofit organizations and generally have a mandate to exist in perpetuity, providing a steady stream of income to their beneficiaries. Finally, family offices manage the wealth of high-net-worth families and have the mandate to manage wealth for future generations of family members, requiring a long-term outlook for investments.5

Sadly, even with the large amounts of long-term capital available, the mobilization of long-term investors (LTIs) toward long-term projects is not happening. We still have widening gaps in infrastructure and energy innovation financing. The patient investors needed to support the capital-intense, long-development ventures and projects that could, for example, reduce greenhouse gas emissions at scale simply are not there. We recognize that it is not an investor’s job to solve climate change or fix our infrastructure, but it is the fiduciary obligation of a pension fund or endowment to maximize financial returns. Investing in these long-term projects in the right way has shown to be financially rewarding.6 There may be an abundance of LTIs, but for a variety of reasons, most LTIs are not exercising their long horizon.

This is partly because the investment management process involves many parties and intermediaries, such as asset managers, placement agents, and consultants. These intermediaries provide expertise in information gathering and scale advantages in investment costs. However, the multiple layers of intermediation can also create agency conflicts and misalignment of objectives. If institutional investors delegate the asset management to intermediaries in order to shift responsibility and reduce perceived risk, they then violate their fiduciary duty and may not be acting in the best interest of their beneficiaries.7

In the case of infrastructure, the situation is quite paradoxical. Most governments around the world are sitting on a large backlog of infrastructure projects that they are unable to fund effectively. And yet the same governments are also often in control of large pools of pension or sovereign assets that they struggle to invest effectively. Clearly, there are bottleneck issues around the way in which the largest long-term sources of capital in the world are intermediated with the long-term projects that are most in need of investment. A lot of the funding has to come from “off-balance-sheet” transactions for these governments, as many do not have the capability to fund the projects because of already high debt levels. While pension funds and sovereign funds have a primary commercial objective, we argue that their long-term characteristics make them more amenable to achieving wider long-term economic and social goals, compared with short-term-oriented, opportunistic types of investors such as certain asset management firms. On top of this, if pension funds and sovereign funds do achieve their long-term financial objectives, it is likely that these benefits will accrue back to the citizens of governments that need the funding. This book tries to address how more of these benefits can be enjoyed by asset owners rather than be disproportionately swallowed up by opportunistic financial intermediary firms.

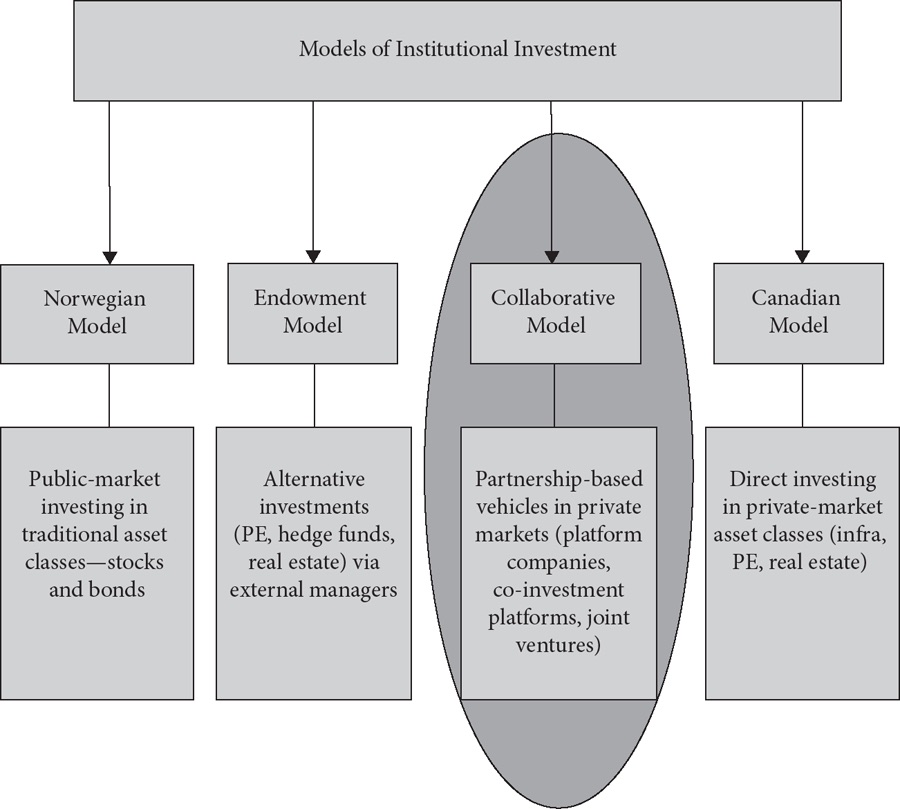

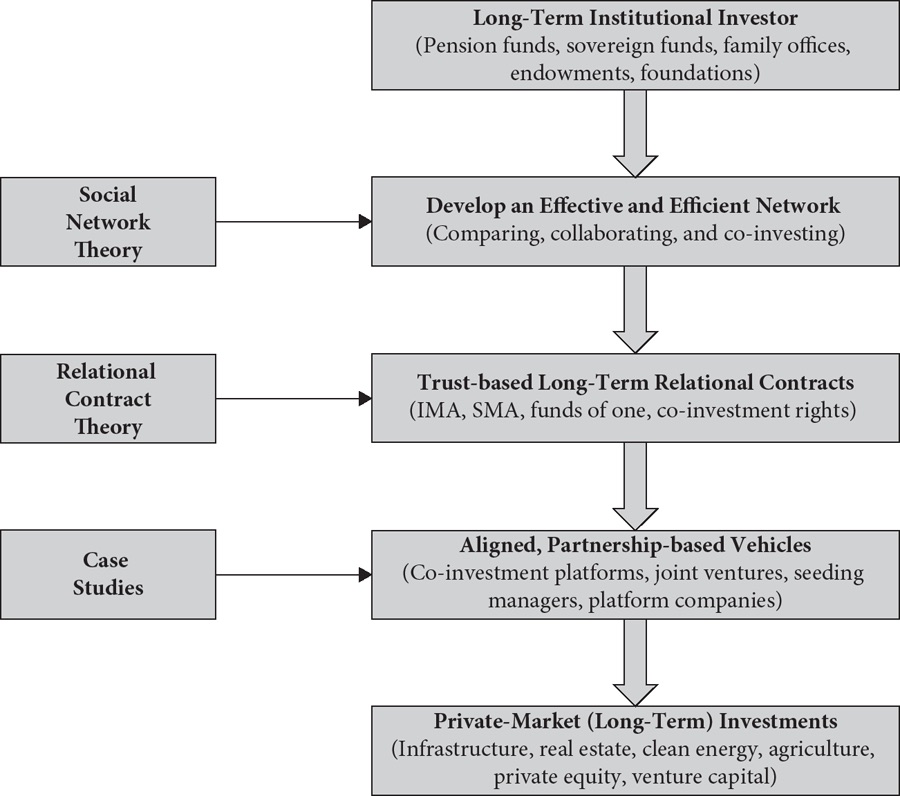

There is ample academic and empirical evidence to show that institutional investors that are able to invest directly into private assets can outperform those that delegate their asset management function to external intermediaries.8 There is also evidence to suggest that allocations to private-market assets can have significant benefits to institutional investors.9 As a result, many investors are looking to increase their allocations to private markets. Given these trends in the industry, this book looks at how institutional investors can access private-market assets in the most efficient way possible. In essence, the book argues for and provides the premise for the collaborative model of institutional investment. Such a model is based on institutional investors developing an efficient and effective network to form long-term relationships with trusted investment partners. The collaborative or partnership-based model of institutional investment combines aspects of the Canadian direct investing model and the David Swensen–pioneered endowment model of investing in private market assets10 with some new collaborative mechanisms and strategies. This is depicted in Figure 1.1. We use the term re-intermediation to explain the rationale behind the collaborative model of long-term investing. Three main components to the re-intermediation thesis are proposed here:

First, as has been mentioned (and backed up by the literature), institutional investors that can in-source investment management services and make direct investments should do so. The universe of direct investors has been increasing steadily as a result of greater inflows of assets and the realization that their process can be more efficient.

Second, while financial intermediaries have gained excessively in the past at the expense of many institutional investors, the financial services industry has been established for a significant period of time, and substantial value has been created by a number of these organizations providing the services of fund placement, asset management, consulting, and advising. As Warren (2014) states: “the asset management industry has been a source of economic growth, as a valuable intermediary in the savings-investment channel.” The second aspect of the re-intermediation thesis is thus focused on constructive engagement with intermediaries. Investors that cannot invest directly should engage with intermediaries in a novel way to ensure that the interests of asset owners are more aligned with those facilitating the deployment of capital. Specifically, this alludes to asset managers, fund of funds, consultants, and placement agents restructuring their business models to ensure that they are adding real value to the investment management process in a transparent, honest way.

Third, co-investments made by specific-purpose vehicles or platforms where peer investors come together to invest is also part of the re-intermediation process. The idea here is to bring like-minded investors together in a club or joint venture arrangement with a specific mandate to invest collaboratively into certain assets. Although some sophistication would be required among co-investors to be a part of such a vehicle, these initiatives may allow slightly smaller investors to gain access to private-market deals in a much more aligned way than through the fund manager route.

Central to the re-intermediation thesis is the need for investors to form an effective, efficient network to facilitate investments into the informationally opaque private-market asset classes. This involves developing strong relationships with peer investors as well as with intermediaries and other parties to form aligned investment partnerships that help achieve the objectives of the investment management process. In order to analyze these interorganizational dynamics at play, we draw on sociology theory to support the arguments in this book.

While the intention here is not to be an academic textbook, we use economic sociology theory to illustrate the importance of investors building their network. Economic sociology theory is also used to inform investors of how a more relational, transparent form of governance can be achieved with their intermediaries. We then provide case studies of how innovative partnership-based vehicles are being set up by institutional investors to illustrate how investors can get closer to the assets of interest.

The Value of Long-Term Investing

Institutional investors that exercise their long-term investing capabilities can add significant value to society and the wider economy. Long-term investors can have positive influences on individual businesses by realizing long-term value creation and improving their longer-term prospects. Theoretically, they can provide liquidity during critical times and help stabilize financial markets. When acting in a long-term manner, they are not prone to herd mentality and can retain assets in their portfolios in times of crisis, and in this way play a countercyclical role.

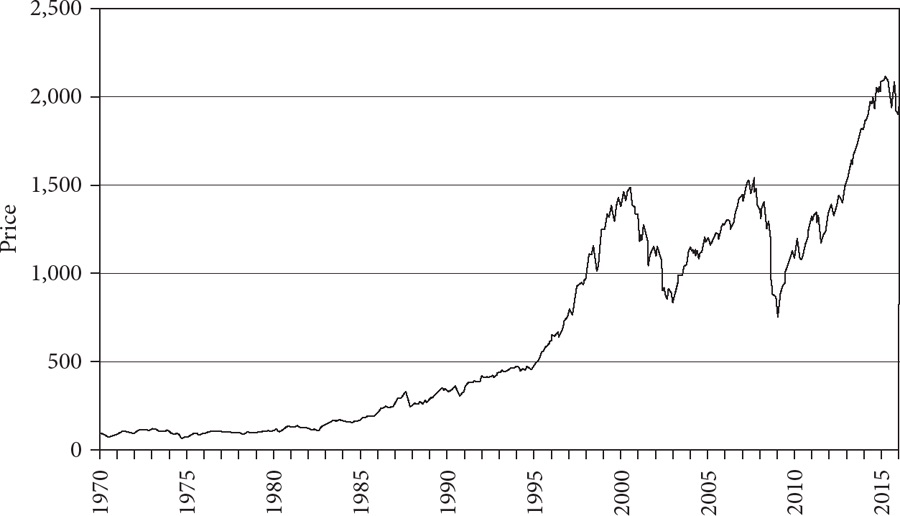

While this book is predominantly focused on private-market investing, the drawbacks of short-termism for an institutional investor can be seen through the returns of the U.S. stock market. As indicated in Figure 1.2, the S&P 500 since 1970 has grown in value a hundred times over. However, between 2000 and the end of 2009, the return of the market was in fact negative (–0.3% nominal, –3.0% real). An investor that held stocks for the whole period compared with just between 2000 and 2009 would have reaped significant benefits.

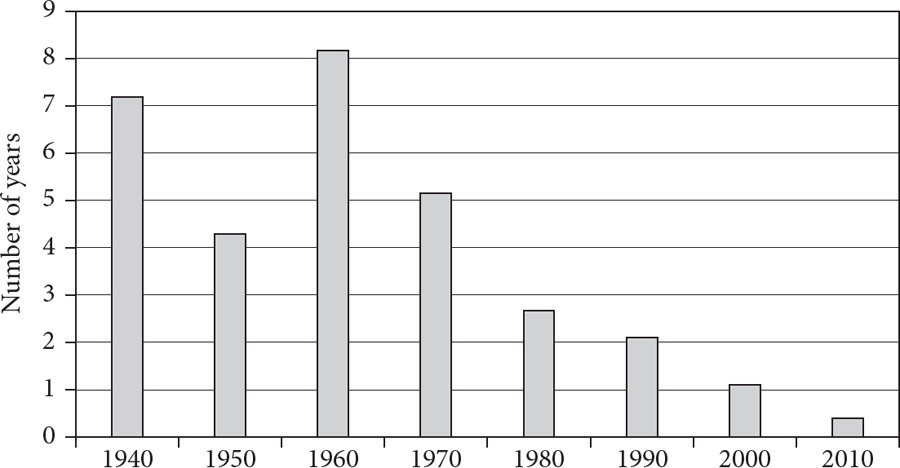

Figure 1.3 illustrates how short-termism has crept into the investment decision-making process for investors with the average holding period of stocks declining significantly over the last 50 years. This is true for most stock indices around the world:11

The Harvard Management Company (HMC), which is responsible for the investment of Harvard University’s endowment fund, illustrated how institutional investors can be crippled by short-termism. In the 2008–2009 financial crisis, because of the lockup of its capital in risky derivative instruments offered by external asset managers, HMC faced a liquidity crisis to cover its operating budget. As a result, HMC was forced to sell a number of its stakes in illiquid asset classes at large discounts, resulting in large losses for the endowment. In this way, HMC suffered as a result of not taking advantage of its position as a long-term investor to reduce the effects of cyclical downturns.12

SOURCE: S&P via Yahoo! Finance.

SOURCE: LPL Financial, New York Stock Exchange (NYSE).

Investors with a long-term perspective stand to make better returns by accessing risk premia, taking advantage of macroeconomic trends, influencing better corporate governance, avoiding buying high and selling low, and minimizing transaction costs.13 Long-term investors are more able to buy assets at distressed prices during market dislocations and to access asset classes and investments closed to investors with more limited time horizons. The potential for higher returns has benefits for long-term savings and pension funds, thus alleviating some of the funding gap that is widening because of low interest rates and an increased demographic burden. Beneficiaries of institutions and general taxpayers stand to benefit from the implementation of long-term investment strategies. In the economic environment following the 2008–2009 financial crisis, characterized by low yields, mounting volatility, low global economic growth, and below-average investment returns, the contrast between short-term transaction-oriented markets and opportunities in long-term nonpublic assets such as real estate, infrastructure, and private equity has been particularly accentuated.14

The OECD summarizes the importance of long-term investors in three ways: they provide patient capital that yields higher net investment rates of return by taking advantage of illiquidity premia and lowering turnover; they provide engaged capital that promotes better corporate governance as shareholders are encouraged to adopt ongoing and more direct roles in investment strategies; and finally they provide productive capital that supports sustainable growth, such as infrastructure development and green energy, and fosters competitiveness and economic growth.15 In contrast, short-termism undermines the ability of companies to invest and grow, with the missed investments having wider-reaching consequences in the economy, including slower GDP growth, higher unemployment, and lower return on investment for savers.16

We are not the first to posit that large institutional investors can make an important contribution to growth, in particular through financing long-term projects, such as infrastructure, clean technology, real estate, and agriculture.17 Infrastructure in particular has been the subject of much attention for attracting long-term investment, as most nations around the world struggle to address their infrastructure investment deficits. Infrastructure provides significant benefits by contributing to economic growth, which further emphasizes the value of long-term investors in these assets.18

Infrastructure services are physical facilities that provide the building blocks of a functioning society. Within this broad concept, social infrastructure (e.g., health and education) can be distinguished from economic infrastructure. Economic infrastructure relates to the channels, pipes, conduits, and apparatus that deliver power and water, provide protection from floods, and take away waste. It also includes the roads, railways, airports, and harbors that allow the safe movement of people and goods between communities. These services directly support the well-being of households as well as production activities of enterprises at various points of the value chain and are thus directly relevant to the competitiveness of firms and to economic development.19

Specifically, the power industry, comprising generation, transmission, and distribution, forms an integral part of the backbone of a modern economy. Without adequate investment and a reliable supply of power, an economy is unable to function efficiently, and economic growth targets are difficult to achieve because of outages and blackouts. An integrated transport infrastructure that includes roads, railways, airports, and seaports makes it possible to link underdeveloped areas into the global economy. Investments in transport infrastructure allow goods and services to be transported more quickly and at lower cost, resulting in both lower prices for consumers and increased profitability for firms. Water infrastructure relates to the delivery, treatment, supply, and distribution of water to its users as well as the collection, removal, treatment, and disposal of sewage and wastewater. Investment in water infrastructure is crucial for sustaining the central role that it plays in human societies while also protecting aquatic ecosystems, which is critical for the environment.20

A number of studies have shown the relationship between infrastructure investment and economic growth. Most of the research in this area has been based on the production function approach, where output elasticity with respect to public capital (regarded as a synonym for infrastructure) is calculated to determine whether higher rates of government expenditure can increase long-run growth rates.21 Early work indicated that a positive relationship exists between private-sector output and infrastructure investment.22 The direction of causality and quality of data were highlighted as limitations of the early studies; nevertheless, further work has also shown a positive relationship between public capital and private output.23 Using an annual time-series growth regression, Égert and colleagues (2009) provide additional evidence showing that the contributions of infrastructure have a positive impact on economic growth.

Investments in other private-market asset classes can also be seen to have wider economic impacts. Venture capital investments that back entrepreneurs and new businesses, for example, have been proven to contribute to economic development.24 The businesses that benefit from venture capital financing can result in new employment and the stimulation of related businesses or sectors that support a new venture. Through unique offerings of new goods and services and production processes, entrepreneurs can improve efficiency, and innovation leads to economic growth.25

Similarly, certain real estate development investments have provided economic benefit, particularly those in underdeveloped areas, which could be classed as targeted investments.26 In fact, institutional investors that have had a specific development focus on investing in real estate, private businesses, and infrastructure have been able to post attractive investment returns.27

By 2030, as global population surpasses eight billion, there will be significant increases in food demand, placing pressure on agricultural crops. Investments in agriculture seem to be suited to LTIs and necessary for improving output productivity to meet global demand. The growing middle class in the developing world will be looking to consume more and more protein. A shift toward greater global protein consumption will increase demand for grain dramatically. On top of this, continued development and industrialization will reduce the land resources for agriculture. All of these long-term economic factors will drive the value of agriculture assets, highlighting the attraction for long-term investors in this area.28

Clean-technology companies that help mitigate climate change require significant amounts of financing and should be ideally suited to long-term institutional investors. In the past, in order to access green energy opportunities, investors would normally seek out a third-party asset manager to do an inventory of the investible assets and make investment decisions. But the scale and time horizon of these companies do not often fit within the fund structures of existing intermediaries, which is partly why so few investors made attractive returns in this sector over the past decade. In our view, the best sources of capital for clean-technology companies are more often than not LTIs. LTIs have intergenerational time horizons and deep pockets, which makes them valuable partners for capital-intensive and long-gestation companies. In this way, by leveraging off their key attributes (scale and time horizon), institutional investors stand to make attractive returns and have significant impact.

Barriers to Long-Term Investment

Despite the many benefits and advantages of institutional investors investing in long-term private-market assets, not only to achieve greater returns but for the wider economy, a number of other intrinsic constraints inhibit the flow of capital. The extent of each constraint for long-term investment will depend on the type of investor. There are also general behavioral theories and explanations for why short-termism may creep into the investment decision-making process of institutional investors. Structural factors may make it difficult to implement some of the ideas from this book. The objective, however, is to educate the reader on how novel methods are being developed to address some of the challenges and how the industry may be shaped in the future.

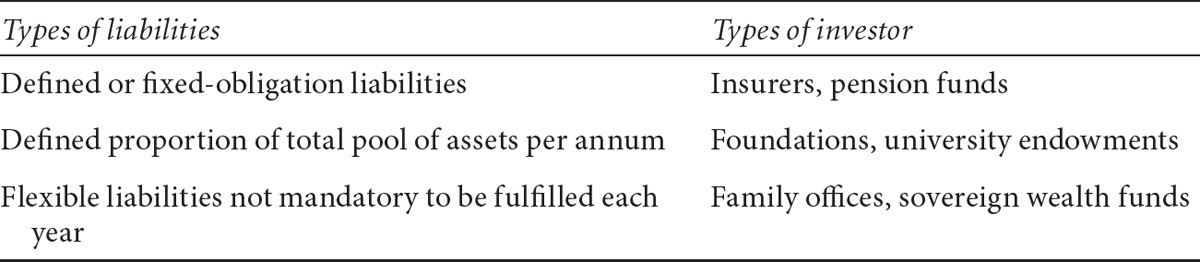

The first key constraint that may affect the investment time horizon of an institutional investor is their liability profile. Institutional investors that need to make payouts in the near term may not be able to invest in illiquid investments that have long lockup periods. They may not be able to take on short-term volatility, which prohibits them from holding assets over the long-term. Pension funds, endowments, and foundations have a proportion of their current asset base that needs to be distributed over a given time period. Family offices and sovereign wealth funds have minimal short-term liabilities and can therefore afford to devote a larger proportion of their assets to long-term assets. The types of liabilities are summarized in Table 1.1.

Related to the liability constraint is that of funding risk. An ongoing focus on funding ratios or capital adequacy may induce a short horizon, even though the funding is secure or the liability is relatively predictable. An example of this occurred when the Harvard endowment fund suffered because of an unanticipated need to sell illiquid assets to meet cash flow needs during the global financial crisis (GFC). An investor who acknowledges that they may be forced into selling positions at short notice may be reluctant to take long-term positions, especially in illiquid assets that they cannot readily exit in the event of redemptions.

TABLE 1.1 Types of investor liabilities

Another consideration is whether an institutional investor is facing net inflows or net outflows from their fund. Investors will be more confident that they will not be placed in the position of needing to sell into weak markets if they are confident that they will continue to draw inflows. Using data from 152 large superannuation funds in Australia during 2004–2010, Cummings and Ellis (2015) provide evidence that fund flows influence the weightings held in illiquid assets. In particular, although the authors note that the heterogeneous nature of funds makes correlations difficult, they deduced that larger funds with larger positive fund flows have a larger weighting to illiquid assets.

The risk appetite of an institution depends on a number of restrictions and will determine whether a long-term investment strategy will be employed. A long-term institutional investor should be willing to accept moderate levels of risk, short-term volatility, and potential permanent capital loss and not divest from long-term investments in the face of market pressure.29 However, investors that have defined liabilities are often heavily regulated, which affects their risk profiles and how risky assets are treated in their accounts. Some regulators require investors to hold high capital ratios if investments are made into illiquid investments, which influences them to invest in low-risk assets. The pressure faced by asset owners to maintain funded status in the short term and report to the market on a short-term basis results in many investors having a low-risk appetite.

Other types of stakeholders may also put pressure on long-term institutions and influence their risk appetite. Large public pension funds and sovereign wealth funds may be subject to the opinions of politicians who may feel alarmed whenever volatility in asset prices leads to a dramatic fall in a fund’s value, regardless of whether that volatility had been taken into account. This type of pressure will make certain investors cautious about making the investments in the first place. Similarly, endowments and foundations face pressure from their trustees to perform in the short term, with operating budgets for certain institutions coming from their funds. When short-term gains are made, this often leads to an increase in spending, making it difficult to invest for the long term.30

The investment decision-making process within an institutional investor organization may also provide constraints for the implementation of a long-term investment strategy. Social structures within firms and groupthink can contribute to an organization’s reluctance to adopt a long-term view.31

Investment managers are often incentivized to maximize their performance over the short term, in line with bonus and other compensation payouts, or their performance may be pegged to an index benchmark such as the S&P 500, discouraging investment decisions to be made over the long term with different performance trajectory to the benchmark employed.32

Another important consideration is the length of the decision chain from the principal to the ultimate deployer of capital. Kay (2012) suggests that this chain creates misalignments such as bias for action, as agents aim to justify their positions. The longer the decision chain, the higher the prospect of misalignment and the higher the cost of investments. The principal agent issues between asset owners and managers is a key motivation behind this book. The problem is further addressed later in this chapter. Chapter 3 on re-intermediating managers also returns to the subject and attempts to provide solutions.

Behavioral and psychological issues have also been attributed to the short-term tendencies of investment institutions.33 Academic research in biology and neuroeconomics has shown that emotional and cognitive processes interact and affect the ability to make decisions for the long or short term. These studies indicate that a preference for immediate consumption may have emerged as a survival strategy.34 Similarly, desire for immediate gratification has been found to be stronger when rewards are more salient.35

Atherton and colleagues (2007) highlight the role of accepted behaviors and norms such as the materialistic society we live in, which demands immediate returns and satisfaction. This can drive short-termism and is seen as the accepted way of doing things, creating peer pressure to conform.

Long-term investing requires a certain amount of resource capability to address the unique types of risks that are played out over a longer time frame. Certain institutional investors face budget pressures that prevent them from acquiring the necessary research tools and internal expertise to help execute a long-term investment strategy. The market for investing talent is highly competitive, and there are considerable challenges in attracting the necessary expertise because of restricted compensation levels and relatively fewer staff in organizations such as public-sector pension funds and sovereign wealth funds.

Quite often the size of assets of a fund dictates not only the governance and internal capability to evaluate investments but also an institution’s access to opportunities. As a result, smaller institutional investors tend to have more conservative asset allocations compared with the largest institutional investors.

The average tenure of a chief investment officer is approximately four years, meaning that long-term investing can provide a significant career risk.36 The tenure for more junior staff may be shorter and there can be significant pressure to perform within this period to achieve career progression. As a result, assets with a short time frame may be more attractive to invest into.37

There may also be constraints to long-term investment by institutional investors due to implicit understandings about the market and where the highest returns can be achieved. Long-term investment requires the belief within institutions that the returns generated from making long-term investments will be large enough to justify the associated risks, such as liquidity risk. Within an institutional investor organization, principals, trustees, and managers must believe strongly in a long-term investment strategy and understand counterarguments before investments can be made.

Long-Term Investment Constraints: U.S. Public Pension Funds as an Example

The U.S. defined-benefit public pension fund sector has been regarded as an institutional investor model that is based on politicized and underresourced investment operations. Pension funds in the United States are predominantly the result of government policy makers and have grown in size to over $22 trillion in 2014.38 Pension funds in the United States are heavily constrained by policies that affect the risk appetite and decision-making capability of the investment professionals that populate these organizations. In government agencies, there are restrictions on the compensation levels of employees, which has led to a huge reliance on the asset management industry. The trend in the United States has been to limit the direct costs of managing the pension, thus reducing salary and head count, instead of reducing fees paid to asset managers, which are more directly tied to performance and in many cases more difficult to measure. For example, the largest pension fund in the country, the California Public Employees’ Retirement System (CalPERS), paid $1.6 billion in management fees in 2014 to external managers. The average analyst salary in a U.S. public pension fund is $90,000 (a factor of 3 or 4 less than in the private asset management industry), and a team of two to four people could be responsible for a multibillion-dollar allocation.

As a result of the way the system has been formed, a number of principal-agent issues have arisen between U.S. pension funds and their asset managers. For example, the Securities and Exchange Commission (SEC) has been investigating 400 private-equity General Partners (GPs) and found that “a majority of private equity firms inflate fees and expenses charged to companies in which they hold stakes.”39 Similarly, on the asset owner side, major public pension funds in the United States have recently admitted that they do not track hundreds of millions in fees paid to asset managers.40

Many U.S. public pension funds require board approval before certain investments can be made. Board members of a public pension are usually elected representatives of the fiduciary body and not investment professionals. Quite often, the board of a pension fund is also the investment committee, and so investment decisions will need to be agreed upon by the committee before capital can be deployed. This can severely restrict a pension fund from making investments opportunistically into attractive long-term assets. For certain assets like infrastructure that are politically sensitive, gaining approval from the board may be difficult if there are political issues such as labor union effects with privatized infrastructure.

While the liability structure for each fund will be different, the pension crisis in the United States and in many other countries has placed a greater emphasis on sound long-term investment strategies to help fund the increasing deficit between workers in the economy and pensioners retiring. Pension funds need to guard against exposing themselves to complex products with high risks in order to satisfy their aggressive return targets. Certain pension funds will have constraints on investments due to their short-term liabilities; however, it is apparent now more than ever that sound long-term investment strategies will be required by U.S. pension funds to help meet their fiduciary obligations.41

The Characteristics of Private-Market Investing

Private-market investing is an umbrella term encapsulating a variety of illiquid investments that cannot be sold at short notice and therefore require a long-term investment horizon and patient capital. These types of investments, which provide the focus for this book, include infrastructure, renewable energy, agriculture, natural resources, real estate, venture capital, and private equity. The opaque nature of private-market assets and various information asymmetries has meant that a relational form of delegated investing has been adopted by institutional investors for accessing these assets, with a large reliance on intermediaries for the investment process. This is in contrast to direct investing or co-investing, where capital is deployed directly into the asset or company.

Private companies are not subjected to the information disclosure regulations that publicly listed companies must adhere to, giving investment managers the opportunity to gain access to and act on information not readily available in the public domain. Investments in private markets also often require managing the assets actively, playing a material role in growing the assets, and adding significant value over the investment period. Investment management firms have investment professionals dedicated to taking advantage of informational asymmetries in private markets and have the necessary skill set for sourcing, analyzing, executing, and managing long-term assets. For these reasons, many institutional investors without sufficient governance and resource capability have used the services of third-party investment managers and consultants for making investments into private markets.

Investors in private markets should thus expect higher returns compared with public markets because of the premium paid for illiquidity and other asset-specific risks. While the benefits from each asset class vary (as well as the data and benchmark used for comparisons), substantial empirical evidence suggests that private market investing can offer greater returns over investing in the public markets.42 This is particularly true for private equity and real estate. While venture capital fund returns outperformed public equities in the 1990s, they have underperformed in the most recent decade.43 Infrastructure is a relatively new private-market asset class, and so reliable returns data is quite limited. Early studies have shown that infrastructure has been mixed with a large amount of variation in the types of assets and subsequent returns achieved.44

The allocation of institutional investors to private markets has been increasing over time. Andonov (2014), based on the CEM database,45 shows that institutional investors in developed economies have increased their allocation to alternative assets (which also includes hedge funds) from 8 percent in 1990 to more than 15 percent in 2011. He finds that larger institutional investors have increased their allocation in a higher proportion. Larger investors not only allocate a greater percentage of their assets to alternative investments but are more likely to invest simultaneously in multiple alternative asset classes. In addition to size, institutional investors that diversify their public equity investment internationally also invest a higher percentage of their total assets in multiple alternative asset classes at the same time. Institutional investors that use more active rather than passive management in public equity are investing relatively more in alternative asset classes, where passive investing is virtually impossible. The results suggest that institutional investors do not substitute active management in public equity with alternative investments but rather engage simultaneously in active investing in public and private markets. Most industry-based publications and surveys would indicate that institutional investors will be increasing their allocation to private-market asset classes over the next few years and beyond.46 Understanding the most efficient access points for these investments will be ever more important.

The Challenges with Delegated Investing

Investing through external managers is the dominant investment approach for institutional investors accessing private markets. Sponsors of institutional investor organizations have been happy to let the fund’s performance be dependent on the oversight of a long chain of principal agent relationships typically with consultants, fund of funds, and asset managers. Although this method of investing seemed to work for a while, more recently, the GFC exposed the incorporation of incentives at each link of the chain that distorted the original motives of the asset owners. Early studies suggested that many private-equity limited partnerships (LPs) do not outperform public-market benchmarks despite a private-equity boom occurring in the years leading up to the crisis.47 While managers exhibited a certain amount of investment skill as depicted by their gross returns being greater than public-equity benchmarks, the lack of superior return for the LPs implied that “rents” were earned by asset managers. Whatever outperformance might have been achieved may not account for the higher risk (e.g., leverage) and illiquidity of the transactions.48

Agency problems in delegated asset management can occur because the asset owner and the fund manager may have different utilities or risk aversions, incentives, horizons, skills, information sets, or interests. In addition, the principal’s ability to monitor the agent is limited, as it could be expensive or the asset owner may not understand the information being uncovered in the monitoring process. Principals lack the ability to judge whether the agent has talent or is doing a good job. Adverse selection and moral hazard originating from the insurance industry explain the agency problems in delegated institutional investment.49

The principal-agent issues associated with asset management have also been compared to the issue of “broken agency” apparent in the construction industry between the short-term contractors that bear short-term risk and the managers that bear the long-term risk and rewards of the project.50 The misaligned objectives between the two parties can lead to suboptimal outcomes. In the case of institutional investor organizations, broken agency affects how assets are allocated. There may be a severe disconnect between the types of assets and risks that an investor may think they are being exposed to and the actual investments being made by their short-term-oriented asset managers. A way of realigning interests would be to identify asset managers that have the same long-term objectives as the asset owner. The challenge for investors is to determine how they can incorporate their long-term interests in the design and framing of short-term investment policies and strategies.

The biggest issue with regard to delegated investing is the significant costs associated with employing intermediaries to deploy capital. External investment costs include the management fees paid to investment consultants and external asset managers, performance fees, carried interest, and rebates, which are directly subtracted from the returns and are not incorporated into cost figures. External costs also include costs (compensation, benefits, travel, and education costs) for internal staff whose sole responsibility is to select and monitor external managers in alternative assets. On top of the fees, the costs of internal resourcing can be substantial to ensure that the appropriate sophistication is present to get access to the outperformance of top managers (as per the endowment model).51

From the CEM benchmarking database, it was deduced that the average private-equity annual cost was 3.41 percentage points, followed by hedge funds at 1.43 and real assets at 0.84.52 These figures, however, also include investors who have used internal teams to access the asset classes. The typical “2-and-20” external private-equity fund compensation structure can result in a cumulative investment cost of 5 to 7 percentage points per year under a wide range of performance assumptions and after portfolio construction costs have been accounted for.53 If investors are expecting a 5 percent illiquidity premium on these private-market assets, they may end up spending the entire premium on fees.

In some cases, asset management firms have misled investors about the fees that they are charging. Many LTIs present incomplete fee pictures in their annual reports; some funds focus only on base fees and bury performance fees in net return numbers, while others make no attempt to quantify the implicit fees associated with holding, moving, or trading assets (despite the fact that the implicit numbers, such as spreads and transaction costs, can be very high).

The attachment of early infrastructure funds to the investment banking industry illustrates the conflicts of interest arising for institutional investors. First, the fees charged by managers have been excessively high, resembling private-equity fees, despite private-equity returns being higher. This has typically involved a base management fee of 1 to 2 percent and performance fees of 10 to 20 percent, with an 8 to 12 percent hurdle rate.54 Investors have also been concerned over the short time horizon of fund managers, with most funds offering closed-end models around 10 years with an investment holding period of 4 to 5 years. Investors, on the other hand, have been attracted to the asset class for the long duration of investments that can be held for 30 to 50 years. Also, certain organizations lack financial discipline and are conflicted in their motives. These factors have led some investors to find alternatives to the fund manager route, although most do not have the internal resources to be able to invest directly in infrastructure themselves or through co-investments. Whether they invest directly or indirectly, the development of strong relationships among investment partners is crucial for success.55

There are signs that the principal-agency issues in investment management are coming to light and are being addressed. The industry has seen a number of changes compared to the pre-crisis era. In August 2015, one of the largest institutional private-equity investors indicated that it will no longer invest in funds that do not disclose all of their fees.56 The SEC has started to fine certain managers that were guilty of excessively and opaquely charging fees to their investors (although the amounts of the SEC fines have not been commensurate with the amounts of fees that the managers have been charging). Phalippou and colleagues (2015) have shown that half of the private-equity managers that historically charged the highest fees have not been able to raise a new fund since the financial crisis, and the managers that charged the least have all raised a new fund.

Direct Investing the Answer?

As a result of the issues raised previously, there is a growing trend among large institutional investors such as SWFs and large pension funds to reduce the agency problems in the investment management industry by in-sourcing more of their investment operations. Institutional investors believe that in-sourcing can provide benefits from a number of factors. First, sometimes third-party vehicles are not attractive, and access to a given asset can be more effectively achieved on a direct basis. When an investor’s internal resources are developed, all aspects of the organization’s capabilities can be improved as internal teams identify previously unknown gaps in the business. Perhaps the most common reason for in-sourcing is to maximize net-of-fee investment returns and minimize agency costs.57

Despite the benefits, replicating the external market for financial services within a single institutional investor organization raises significant issues related to scale and expertise. Only the very large investor organizations are capable of incorporating traditionally outsourced functions and invest in assets that provide a risk-adjusted return that meets the needs of their beneficiaries.

Size alone, however, does not guarantee success for in-sourcing. With increasing size and complexity come issues of organizational inertia. Without market rivalry and competition for such services, or a limited scope for interorganizational knowledge transfers and spillovers, there is a risk of organizational sclerosis. Coupled with the challenge of how to govern a range of functions, bringing more of the market within the organization is risky. Hence, there are robust organizational reasons why most beneficiary institutions continue to outsource the management of assets to service providers in major international financial centers. Other challenges associated with in-sourcing include attracting and retaining adequate human resources, achieving necessary scale of in-house capabilities to be able to build a diversified portfolio, and overcoming the loss of scale economies realized in their relationships with intermediaries.

In-sourcing requires investors to attract talent with specialist skills and operational expertise on investments but also in risk and compliance. This will require the design of competitive compensation packages. Investors also need to incorporate the technology to assess risk and performance across multi-asset portfolios. In-sourcing thus requires an overhaul of a fund’s operating models and data infrastructures. The in-sourcing requirements can be challenging if the transition is not thought through comprehensively. The Korea Investment Corporation (KIC) is an example of an institutional investor that was unable to execute a direct investing strategy successfully. The direct deals that it had carried out in the early 2000s fared worse than its fund investments, and this was primarily due to a lack of knowledge and experience.58 In the case of KIC, not enough attention had been paid to due diligence and risk management, and the organization had relied too heavily on the recommendations of investment advisors.

In order to be an effective in-house investor, good governance is crucial, as it is the primary mechanism to mobilize the resources of an institution. Direct investors need to streamline the investment decision-making process and be able to move at the pace of transactions. Investment committees that might comprise the board need to break from “calendar time” meeting schedules and be prepared to meet in real time. In general, the governance budget required for in-sourcing will depend on the stock of organizational resources, including the talent and skills of portfolio managers, the processes and protocols of decision making, and the information processing tools that support judgments.59 In summary, it is the people, processes, protocols and systems that are essential for direct investing. The authors acknowledge that gaining these resources and organizational improvements is no easy task. Failure to take the right precautions and steps could lead to undesirable outcomes.60

The attributes required by organizations for in-sourcing can be ranked as fundamental (people, organizational, risk management), intermediate (culture, asset selection, mandates) and advanced (delegation and segregation, communication, networks).61 It is the last advanced attribute of networks that this book in part proposes as a way to help investor organizations develop some of the other attributes for more efficient long-term investing. A report by the World Economic Forum on direct investing indicates that the progression toward direct investing might be gradual, in which asset owners, having decided to invest in an illiquid asset class such as infrastructure, may use external mandates initially, but gradually move into co-investing with fund managers before gaining enough experience and organizational sophistication that the asset owner is able to optimize their access to the asset class through direct investing.62 In sum, while direct investing would be the most preferred method for institutional investors, it has significant challenges and risks. The collaborative model, which combines direct investing and delegated investing based on forming innovative partnerships, is proposed as a possible alternative to help achieve the long-term investment objectives of institutional investors.

A Framework for Reframing Finance

At the start of this chapter, we proclaimed that the financial crisis exposed a number of inefficiencies and opaque practices within global capital markets. Traditional academic thinking in finance and economics has also come under much scrutiny. Economic geographer and Nobel Prize winner Paul Krugman stated, “Economists fell back in love with the old, idealized vision of an economy in which rational individuals interact in perfect markets.”63 Prominent Berkeley economist Barry Eichengreen proclaimed that “the great credit crisis has cast into doubt much of what we knew about economics.” He went on to say that while the twentieth century focused on “deductive economics,” the twenty-first century will be all about “inductive economics” with research grounded in concrete observations of markets and their inhabitants.64 As a result, economists have become more interested in explaining the social, political, and geographical dimensions of economic life. In an attempt to supplement their theoretical arguments with more intensive empirical research, economists have moved closer to a social perspective as well as to sociology.

In order to understand the evolving dynamics of institutional investor organizations, their agents, and their relationships with capital markets, we adopt an economic sociology and geography approach in this book. We draw upon many useful works within finance and economics, but the application of economic sociology and economic geography to study institutional investor investment decision making represents a novel way of approaching this evolving research area.

The field of modern economic sociology was manifested by Mark Granovetter’s paper titled “Economic Action and Social Structure: The Problem of Embeddedness.”65 Granovetter’s research grew out of the realization that the weakest point in economics analysis is the neglect of social structure. He therefore argued that sociologists should attempt to embed economic actions in social structure, conceived as ongoing interpersonal networks.66 Economic sociology, as used in this book, draws on social network ideas, organization theory, and the sociology of contracts. Economic geography, which in part stems from economic sociology, helps conceptualize the geographic and political embeddedness of institutional investment. In particular, we build on the work of Gordon Clark, who in many ways pioneered the field of institutional investor governance within economic geography.

From Granovetter and Swedberg’s The Sociology of Economic Life, we would like to highlight three basic principles of economic sociology:

1. Economic action is a form of social action. While economics adopts the rather unrealistic actor—Homo economicus—sociology takes real actors in their interactions as the point of departure. Economic actions typically are not only determined by self-interest. Trust, norms, and power influence economic actions and therefore invalidate the pure self-interest assumption. Related to this, no economic action takes place in an abstract space; there is always a broader social context, which affects the actions of the individual. Economic sociology emphasizes that an actor’s search for approval, status, sociability, and power cannot be separated from economic action. The decision to work for an asset management firm over an asset owner is an example of this. In this way, economic sociology may be more broadly equipped to deal with different empirical issues. A further example arises when analyzing investment management contracts. The financial services industry has accumulated a lot of wealth and power over the last few decades, which has consolidated their bargaining status and at times led to opaque contractual arrangements. We argue that a sociological approach, which takes into account trust-based relational contracting norms and recognizes the characteristics and wider needs of both parties, is needed when formulating investment management contracts.

2. Economic action is socially situated, embedded in ongoing networks of personal relationships, rather than being carried out by “atomized actors.” Network in this context means a regular set of contacts or social connections among individuals or organizations. Action by a network member is embedded, since it is carried out through interacting with other people. Networks are important in finance, and the existence of certain financial intermediaries is due to the way networks are structured in the investment management process. Institutional investors should systematically build an efficient and effective network to help them gain access to attractive investment opportunities as well as to help with knowledge sharing and general organizational development.

3. Economic institutions are social constructions. Rather than considering institutions an objective, external reality, here we propose that they are typically the result of slow, social creation. Granovetter conceptualized the idea of path-dependent development to organizational and institutional forms. He argues that “economic institutions are constructed by the mobilization of resources through social networks, conducted against a background of constraints given by previous historical development of society, polity, market and technology.”67 Networks play a significant role especially at an early stage in the formation of an economic institution. It is crucially important to understand the historical development of institutional investor organizations in order to appreciate how these institutions might be able to invest. Certain pension funds have well-ingrained structures and processes with strict regulations constraining their ability to invest. Sovereign wealth funds, on the other hand, are newer organizations and may have a better ability to attract talent, make decisions quickly, and adopt innovative strategies for investment management. While a number of strategies are proposed in this book, we acknowledge that their implementation is organizationally and geographically dependent. Similarly, we also propose that some of the practices of asset managers, the same practices that have been carried out over the last two decades, need to change. Understanding the historical context helps to acknowledge the inertia and difficulty that may be encountered in promoting change.

• • •

This book takes the lens of institutional investors to understand how more long-term capital can be channeled efficiently into long-term private-market assets. We essentially draw on theoretical and empirical evidence to illustrate how the collaborative model of institutional investment is being shaped and defined. Specifically, the collaborative model of long-term investing proposed here draws on social network theory to understand how institutional investors can not only help develop their own internal expertise but form deep, trusting relationships with potential investment partners. The re-intermediation thesis uses the concept of embeddedness to define how more alignment can be achieved in the transaction between asset owners and asset managers. Case studies that are emblematic of the collaborative/partnership-based model of private-market institutional investment are illustrated to show how these initiatives are being developed, which are likely to influence how the industry will be shaped in the future. The rationale for the collaborative/partnerships-based model and structure of this book is outlined in Figure 1.4.

As mentioned, the motivation for the work in this book comes from the need to further understand the evolving dynamics of institutional investor organizations and determine how these investors can channel their capital into “real,” long-term investments. The collaborative model combines elements of other methods of institutional investment but is distinct and new enough to warrant a detailed theoretical underpinning and a consolidation of the key characteristics. The motivation also comes from the need to understand how these trends might affect the role that different actors and agents will play in the institutional investment management process.

1. We acknowledge that there are other long-term investment strategies also. This book focuses on investments in private-market asset classes.

2. World Bank 2015.

3. Throughout, we use the terms institutional investors, long-term investors (LTIs), and asset owners synonymously to represent the group of investors described in this paragraph. These investors essentially own the capital that they are deploying. They are the direct, legal representatives of the fiduciaries that they represent. This is in contrast to asset managers, who invest on behalf of clients and do not legally own the capital they invest.

4. Sovereign wealth funds can be further categorized as stabilization funds, savings funds, reserve investment funds, development funds, or pension reserve funds. Please see Al-Hassan et al. 2013 for more detailed descriptions.

5. These long-term investors are the focus, although we recognize that a number of concepts in this book may not apply to all types of investors because of their unique characteristics.

6. Harris et al. 2014, Axelson et al. 2013, Robinson and Sensoy 2013.

7. Andonov 2014.

8. MacIntosh and Scheibelhut 2012, Fang et al. 2015, Andonov 2014.

9. Harris et al. 2014, Axelson et al. 2013, Robinson and Sensoy 2013.

10. The endowment model is characterized by a large allocation to alternative assets such as private equity through external managers. The direct model is characterized by a large allocation to alternative assets using an internal team of investment managers. The endowment model was pioneered by David Swensen, CIO of the Yale endowment, while the direct model was pioneered by large Canadian pension funds such as the Ontario Teachers’ Pension Plan (OTPP), the Canada Pension Plan Investment Board (CPPIB), and the Ontario Municipal Employees Retirement System (OMERS). See Ambachtsheer (2012), Swensen (2009), and WEF (2014) for a detailed explanation of these models.

11. Haldane 2010.

12. See http://www.forbes.com/forbes/2009/0316/080_harvard_finance_meltdown.html.

13. WEF 2011.

14. Lagarde 2011.

15. Della Croce et al. 2011.

16. Barton and Wiseman 2014.

17. Clark 2000.

18. Sharma 2012.

19. Morley 2002.

20. United Nations 2008.

21. Solow 1956.

22. Romer 1986, Lucas 1988, Aschauer 1989.

23. Munnell 1992, Gramlich 1994, Lau and Sin 1997, Berechman et al. 2006.

24. Kortum and Lerner 2000.

25. Timmons and Bygrave 1986, Samila and Sorenson 2011, Kortum and Lerner 2000.

26. Hagerman et al. 2005.

27. Temasek Holdings (Singapore): 18 percent IRR over 40 years; Khazanah Nasional (Malaysia): 13 percent IRR since 2004; Public Investment Corporation (South Africa): 16 percent IRR since 2004. Source: Annual reports of respective organizations.

28. TIAA-CREF 2012.

29. WEF 2011.

30. Ibid.

31. Laverty 1996.

32. Stoughton et al. 2011.

33. Warren 2014.

34. Irving 2009.

35. See Warren (2014) for a summary of behavioral and psychological influences on short-term behavior.

36. WEF 2011.

37. Ibid.

38. Towers Watson 2015b.

40. http://fortune.com/2015/09/04/calpers-still-cant-get-out-of-its-own-way-on-private-equity/.

41. Andonov 2014.

42. Harris et al. 2014, Axelson et al. 2013, Robinson and Sensoy 2013, Ljungqvist and Richardson 2003, Stucke 2011, Fisher and Hartzell 2013.

43. Harris et al. 2014.

44. Inderst 2009, Knight and Sharma 2016, Sharma and Knight 2016.

45. CEM Benchmarking Inc. collects data from institutional investors through yearly questionnaires. The data in this study uses detailed information on the strategic asset allocation and performance of institutional investors during 1990–2011

46. Preqin 2014a, Towers Watson 2015a.

47. Malkiel 2013, Kaplan and Schoar 2005, Franzoni et al. 2012, Ljungqvist and Richardson 2003.

48. Franzoni et al. 2012.

49. Ang 2014.

50. Sheffer and Levitt 2010.

51. Blake 2014.

52. Andonov 2014.

53. Gompers and Lerner 2000, Metrick and Yasuda 2010, Fang et al. 2015.

54. Inderst 2009.

55. Torrance 2009, Sharma 2013.

57. Clark and Monk 2013.

58. Dai 2014.

59. Clark and Urwin 2008.

60. The Korea Investment Corporation experienced difficulty in doing direct deals because of insufficient knowledge within a particular sector and insufficient risk management practices. See http://www.wsj.com/articles/korea-investment-corp-learns-hard-lesson-1413962015.

61. Clark and Monk 2012.

62. WEF 2014.

63. http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html.

64. http://nationalinterest.org/article/the-last-temptation-of-risk-3091.

65. Granovetter 1985.

66. Granovetter and Swedberg 2001.

67. Ibid.